Account Status Changes

Last Modified on 11/26/2024 6:41 am PST

Pathway: Accounts > Search > Account

An account status indicates the present state or condition of a customer account within a business. When accessing an account, the current status is visible in the account section of the customer service screen. Clicking on the status will open a read-only Account History popup. Otherwise, right-clicking within the account section of the customer service screen will offer the option edit the status.

The status of an account can be managed either manually or automatically, depending on the configuration of the account class to which the account belongs.

Permissions

The following permissions are required update the status of an account:

| Permission ID | Permission Name |

5

| View Account |

6

| View Site |

7

| Edit Account Status |

Status Descriptions

| Status | Description |

| Inactive | An inactive account status refers to a customer account that is not in use and is not receiving services. After an account has been inactivated, the calendar days in the account calendar will display as gray to indicate the account is no longer active. |

| Prospect | A prospect status refers to a potential or prospective customer account that has not yet been converted into an active customer.

|

| Active | An active status refers to a customer account that is currently in use and receiving services.

|

| Bad Debt | A bad debt status refers to a customer account that has an outstanding balance or unpaid debt that is unlikely to be collected in full.

|

| Credit Hold | A credit hold status temporarily suspends the account's ability to receive services.

Account Class Setup (Setup > Account > Account Class) includes automation settings for updating the credit hold status when the account becomes past-due. This automation is controlled by parameters such as a minimum past due amount threshold and the number of past due days. |

Internal Collections

| Credit hold setting that can be applied to the account if there are no active services for any site. To apply a collection hold to an account, you'll first need to create collection groups and agencies in the Collection Groups and Agencies setup screen. Once set up, these groups can then be assigned in the Account Status History screen when the collection status is selected.

Agencies can be found here: Collection Groups and Agencies |

External Collections

| Credit hold setting that can be applied to the account if there are no active services for any site. To apply a collection hold to an account, you'll first need to create collection groups and agencies in the Collection Groups and Agencies setup screen. Once set up, these groups can then be assigned in the Account Status History screen when the collection status is selected.

Agencies can be found here: Collection Groups and Agencies |

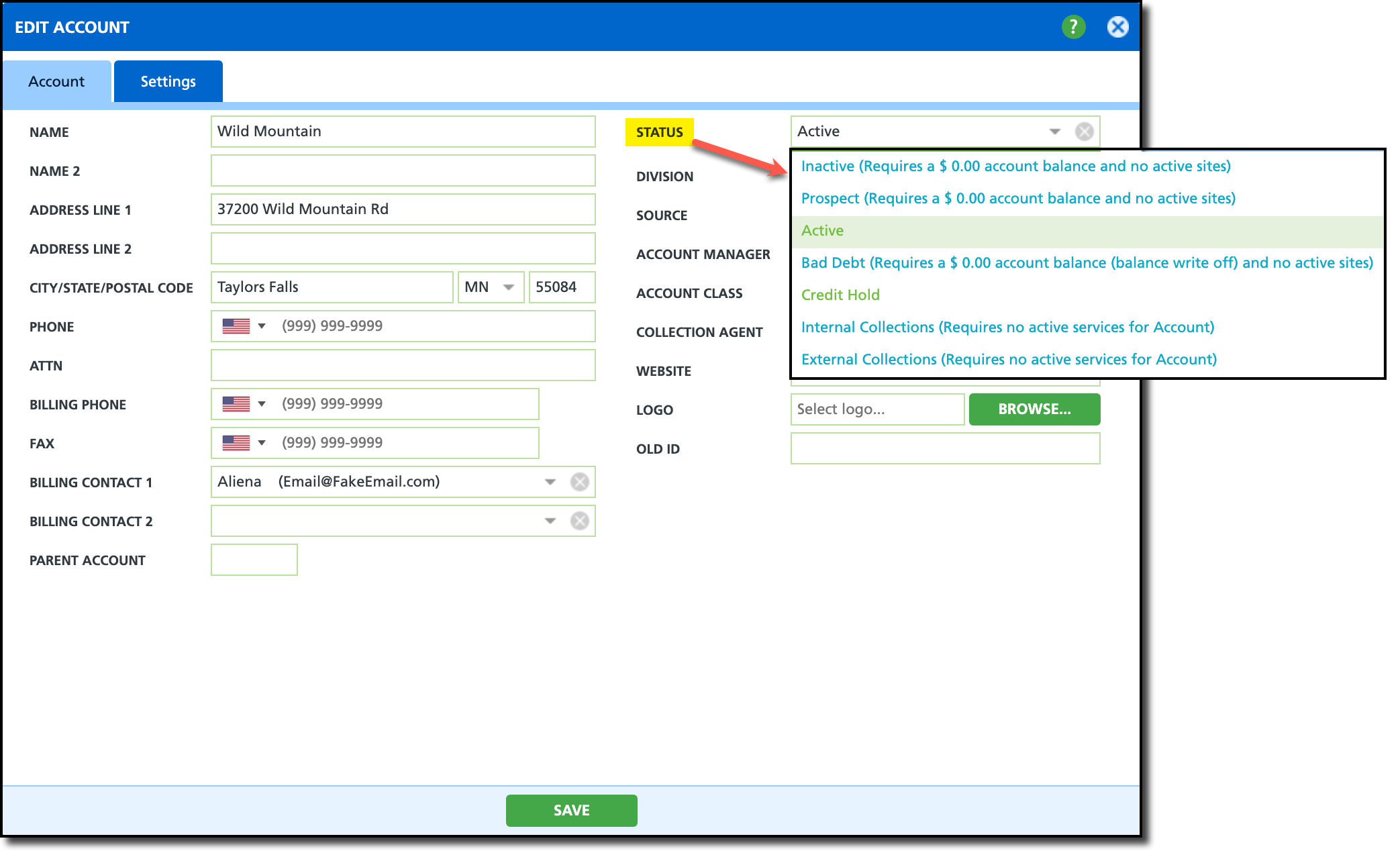

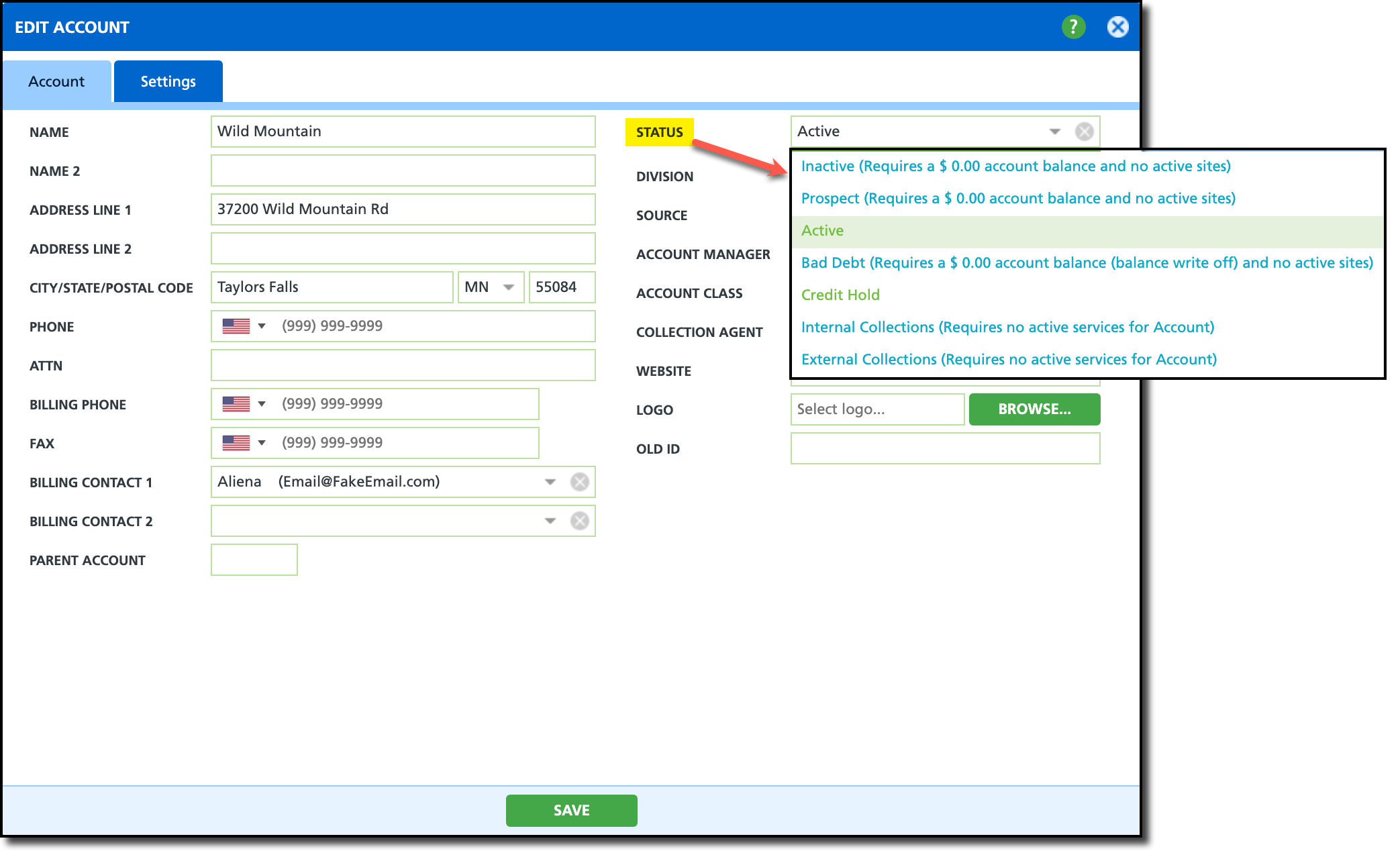

Manually Change an Account's Status

- Search for the Account.

- Right click on the upper left side of the screen (account section) to open the Edit Account tool.

- Select the new Status of the account.

- Upon selection, the Account History window will open to add an effective date and a note with the updated status.

- Click Save when finished.

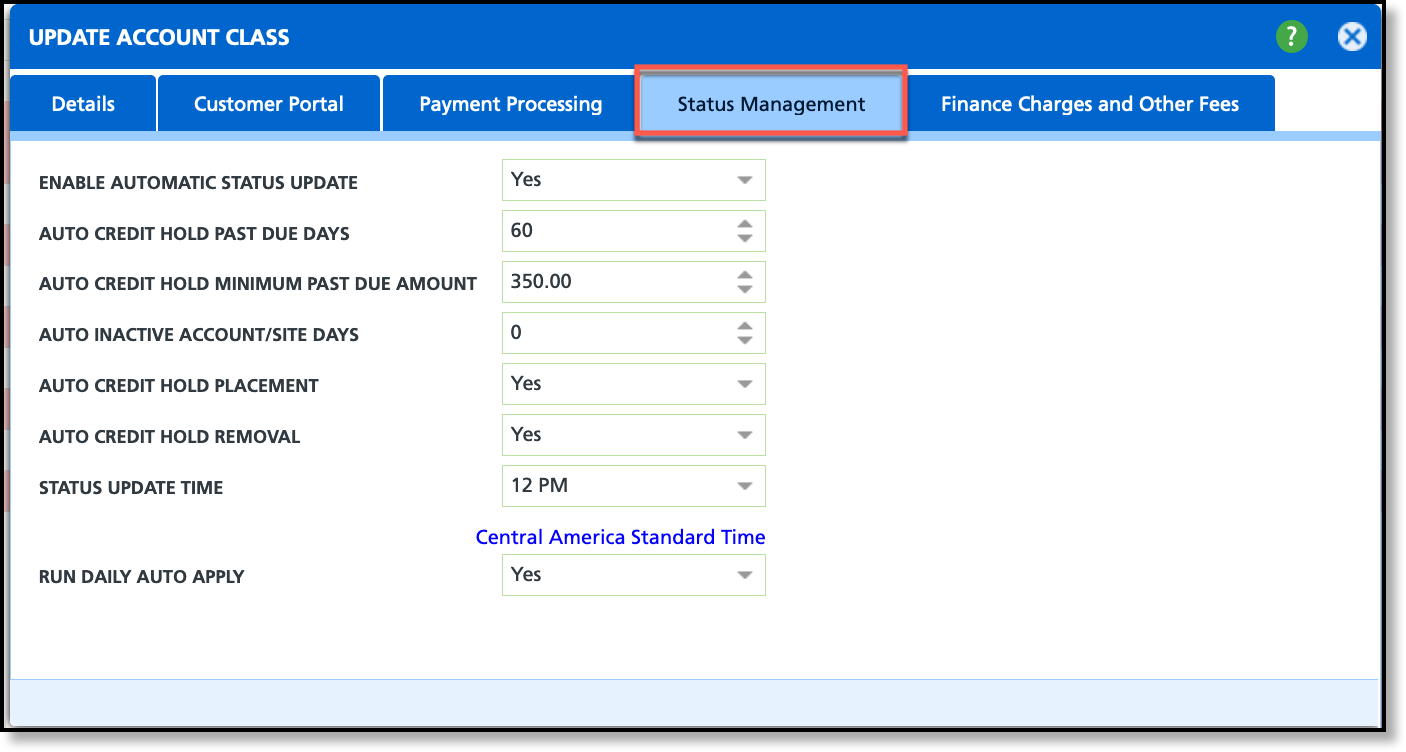

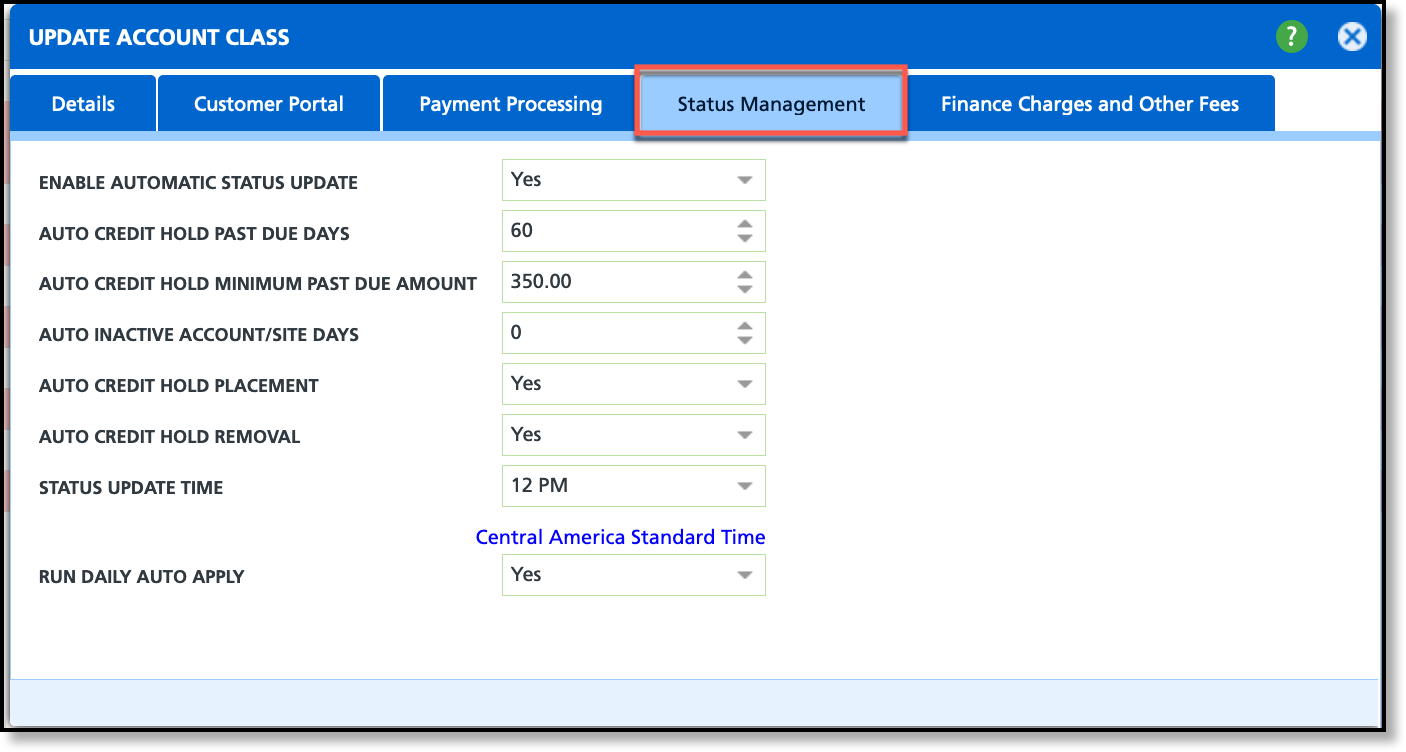

Automate Status Changes (Optional)

Pathway: Setup > Account > Account Class

Global settings can be implemented at the account class level to automate status updates for accounts.

Status Management Field Descriptions

Only the Status Management fields from the Add/Update Account Class screen are included below. Additional information on Account Class can be found here: Account Class Setup.

| Field | Description |

| Enable Automatic Status Update | Select 'Yes' to enable the system to automatically update an account's status. This setting applies to both applying and removing auto-credit hold and other automatic status updates. |

| Auto Credit Hold Past Due Days | Specifies how many days a single invoice must be past due before auto-credit hold is applied. An account requires just one past-due invoice for the credit hold to take effect. Note: 'Auto Credit Hold Placement' must be enabled for settings here to apply. |

| Auto Credit Hold Minimum Past Due Amount | Specifies how much an account must be past-due by before auto-credit hold is applied. Note: 'Auto Credit Hold Placement' must be enabled for settings here to apply. |

| Auto Inactive Account/Site Days | Identifies how many days an account must be marked 'Credit Hold' before it is automatically updated to an inactive status. |

| Auto Credit Hold Placement | Setting that directly applies to placing a past-due account on credit hold. Select 'Yes' to allow. Note: This field must be enabled for 'Auto Credit Hold Past Due Days' and 'Auto Credit Hold Minimum Past Due Amount'. |

| Auto Credit Hold Removal | Setting that directly applies to removing an account from a credit hold status after the past-due balance has been paid. |

| Status Update Time | Indicates the time the system will process status updates. It’s recommended to schedule this during off-hours when system activity is low and to avoid disrupting operations. |

| Run Daily Auto Apply | Enables a daily check for unapplied payments and credits on an account and applies them to the account's oldest invoice balances first. |

Temporary Credit Hold Removal

The "Temporary Credit Hold Removal" option is visible exclusively during an active credit hold on the account or site. This feature temporarily lifts the credit hold, using defined start and end dates, to enable servicing even if the payment hasn't been received. It's particularly useful when a customer reports mailing a payment that hasn't been received or applied, allowing the account to be temporarily released for the requested service.