Finance Charges and Other Fees

Last Modified on 02/11/2026 12:48 pm PST

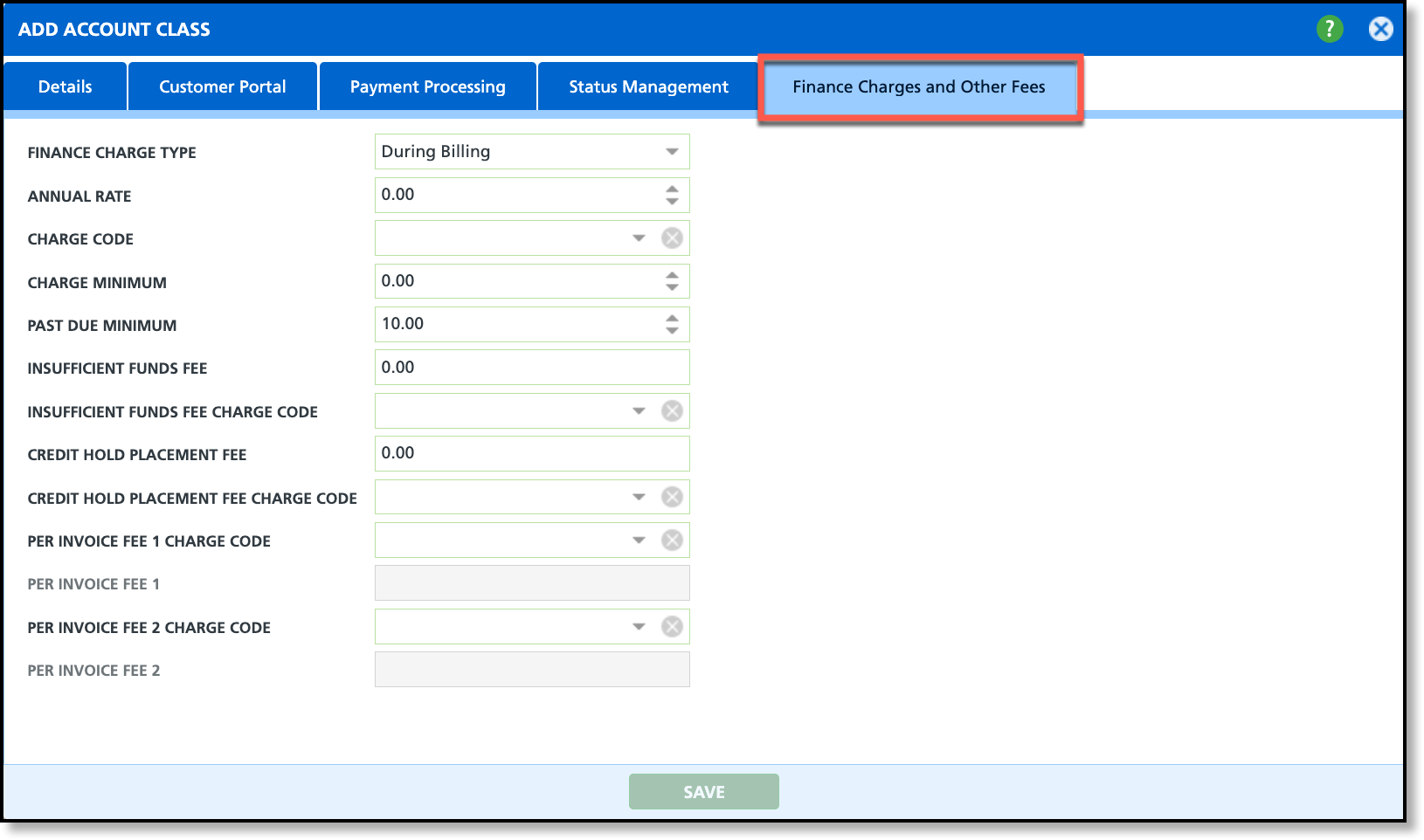

Pathway: Setup > Account > Account Class > Finance Charges and Other Fees

This article explains how to configure finance charges and other fees, which can be applied to an account's invoice during billing. To allow flexibility across account classes, three charge options are available: One-Time Fee Per Invoice, Manual Flat Fee, and During Billing.

Permissions

The following permissions are required to set up Finance Charges and Other Fees:

| Permission ID | Permission Name |

| 23 | Setup \ Account |

420

| Calculate Manual Finance / Late Fees |

Charge Code Setup

To apply a finance charge or or other fee, you must first create a charge code for billing. This code is used in billing and appears on invoices alongside the charge amount. Once created, the charge code can be applied in the Finance Charge and Other Fee setup within the Account Class. Depending on your policy, the same charge code may be used for all finance charge and other fees setup options.

For information about creating a charge code, review the Charge Code Setup article.

Finance Charge and Other Fees Setup

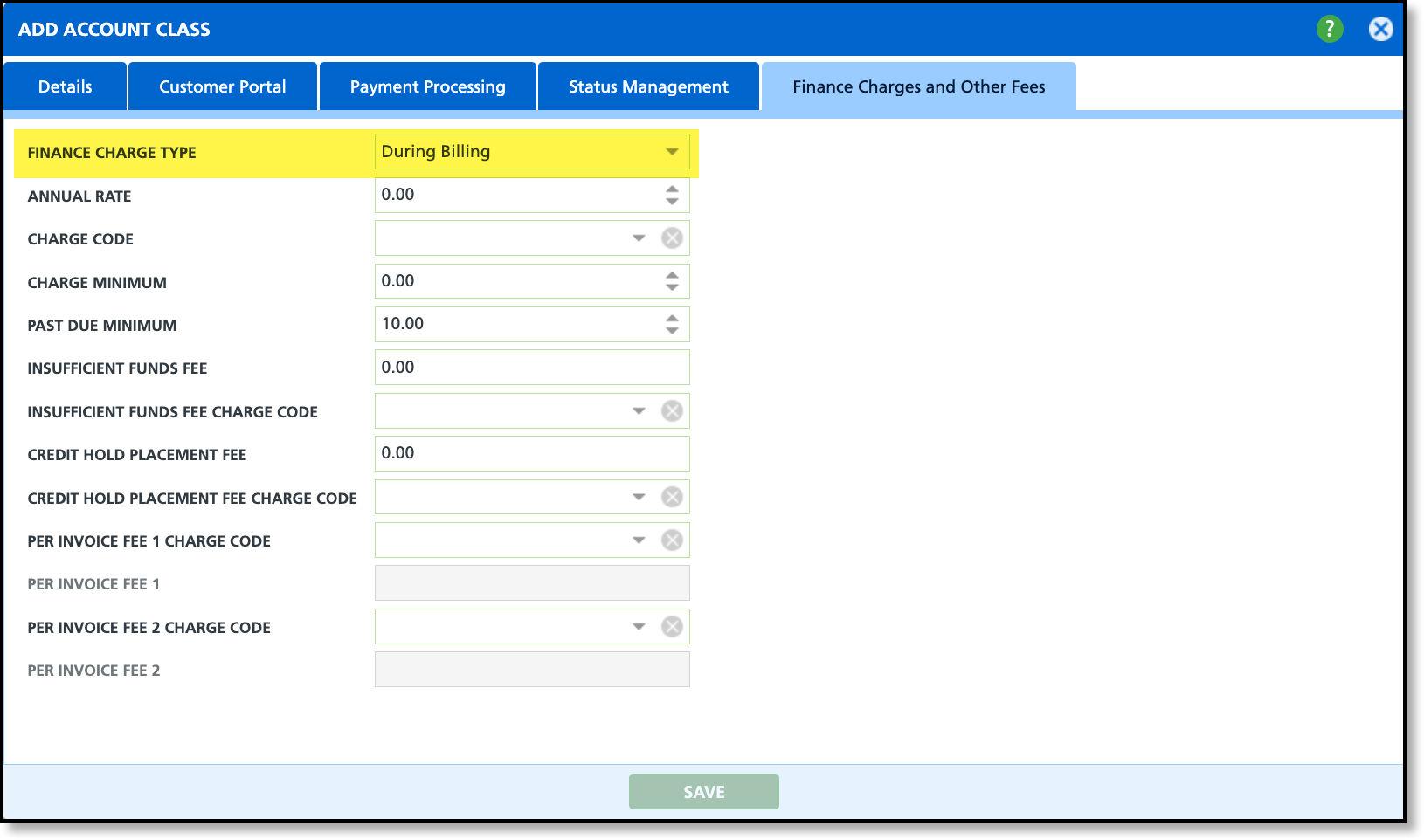

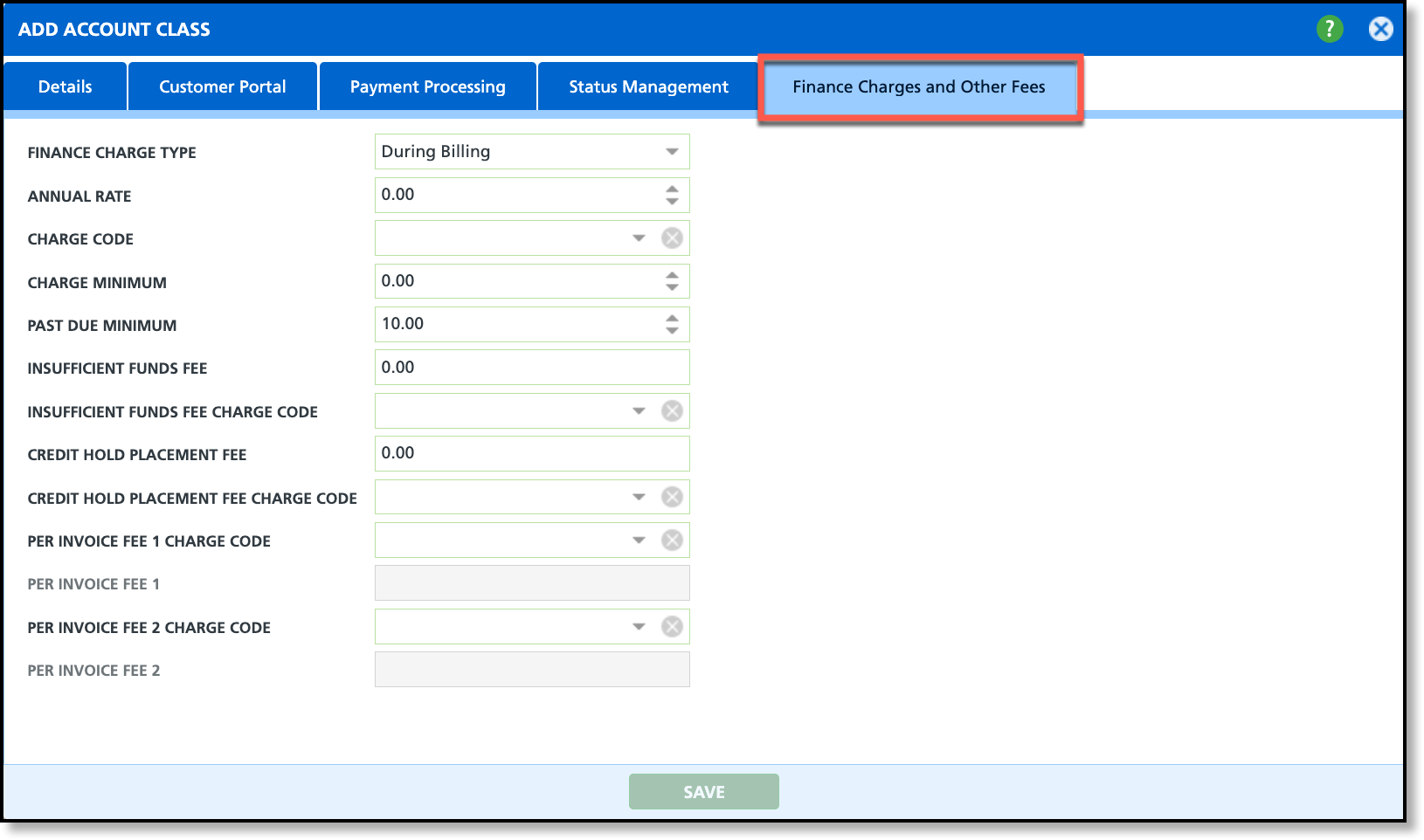

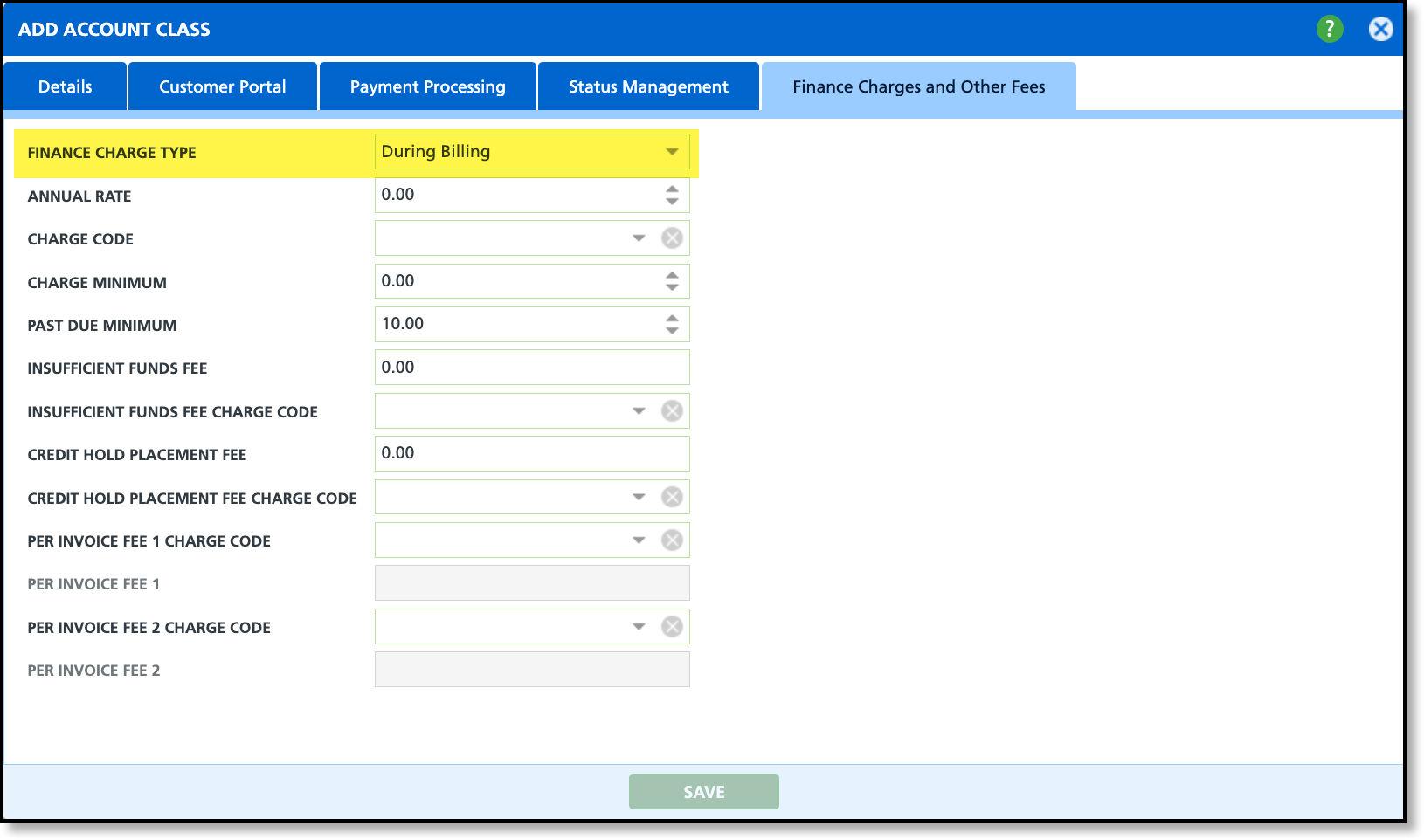

During Billing

With this option, when running a scheduled billing batch, the finance charge or late fee will be calculated during the billing process and included on the invoice.

Setup:

- Select "During Billing" from the Finance Charge Type.

- Enter the Annual Rate that an account will be charged if a late fee applies. This rate is identified as a percentage of the past due amount.

- Select the Charge Code billing will use when applying a finance charge or late fee to an invoice.

- Enter the Charge Minimum; this is the minimum dollar amount an account must be charged. If the calculated finance charge or late fee is less than the charge minimum, the charge minimum is applied.

- Enter a Past Due Minimum; this is the minimum amount an account must be past due by in order for a finance charge or late fee to apply.

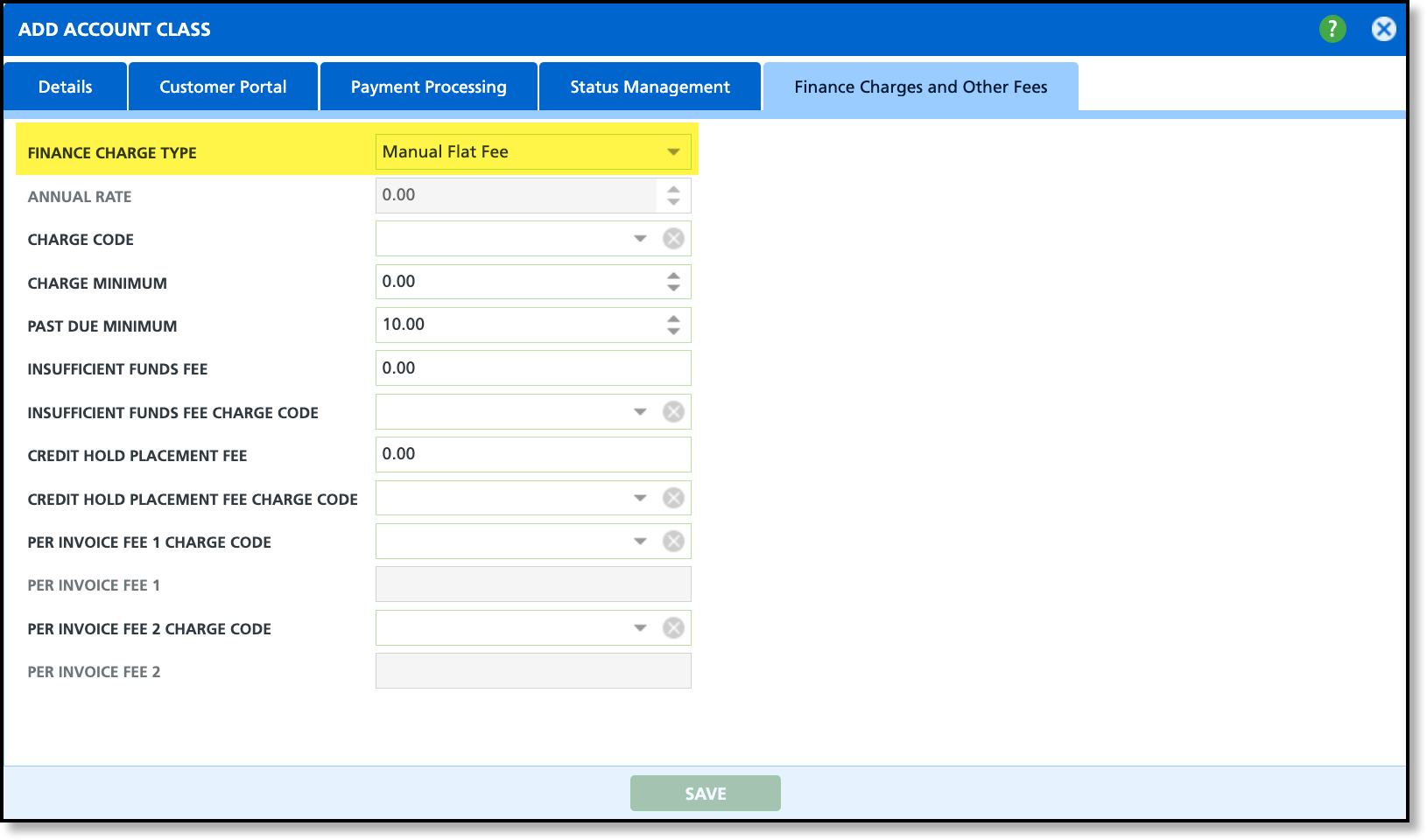

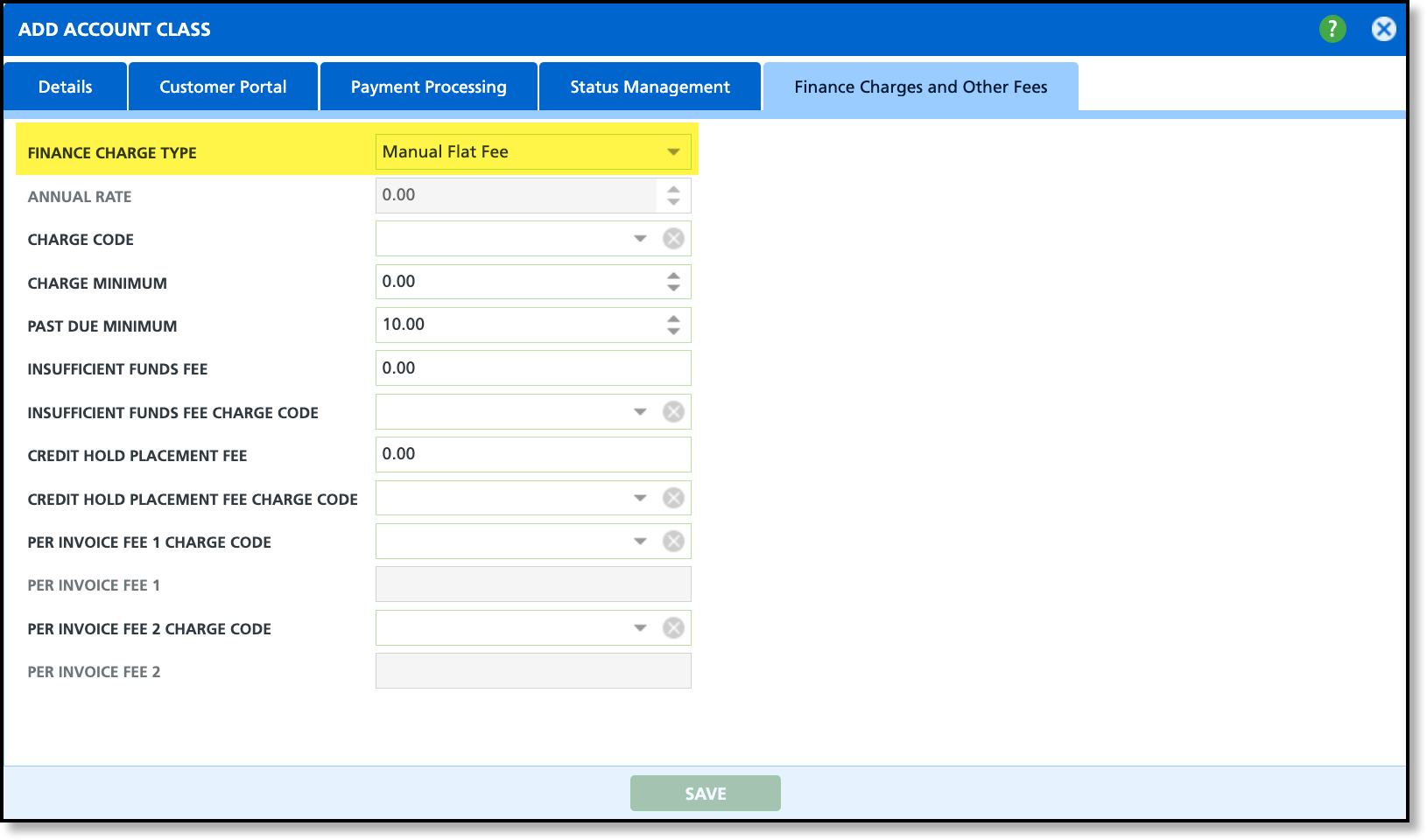

Manual Flat Fee

With this option, a manual flat fee is applied before billing. This finance charge option requires manual processing before billing in Accounting > Calculate Manual Finance Charges and Late Fees, and is further detailed in the 'Manual Flat Fee Process' section below.

- Select "Manual Flat Fee" from the Finance Charge Type.

- Select the Charge Code billing should use when applying finance charges and late fees to an invoice.

- Enter a Past Due Minimum; this is the minimum amount an account must be past due by in order for a finance charge or late fee to apply.

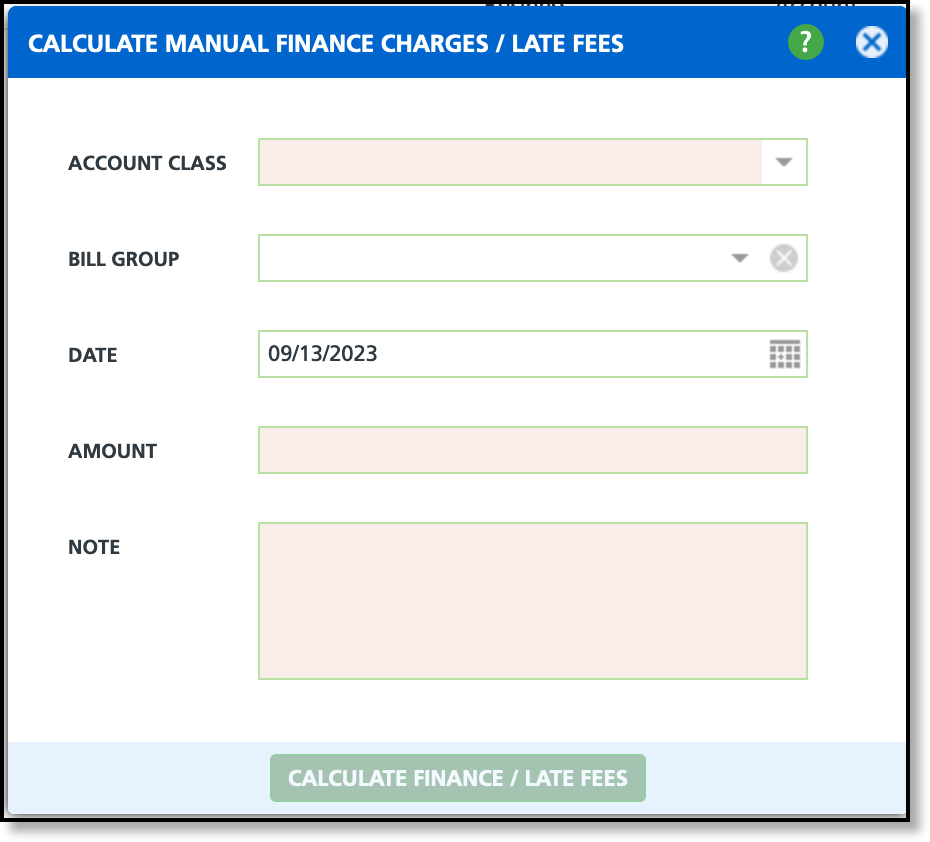

Manual Flat Fee Process

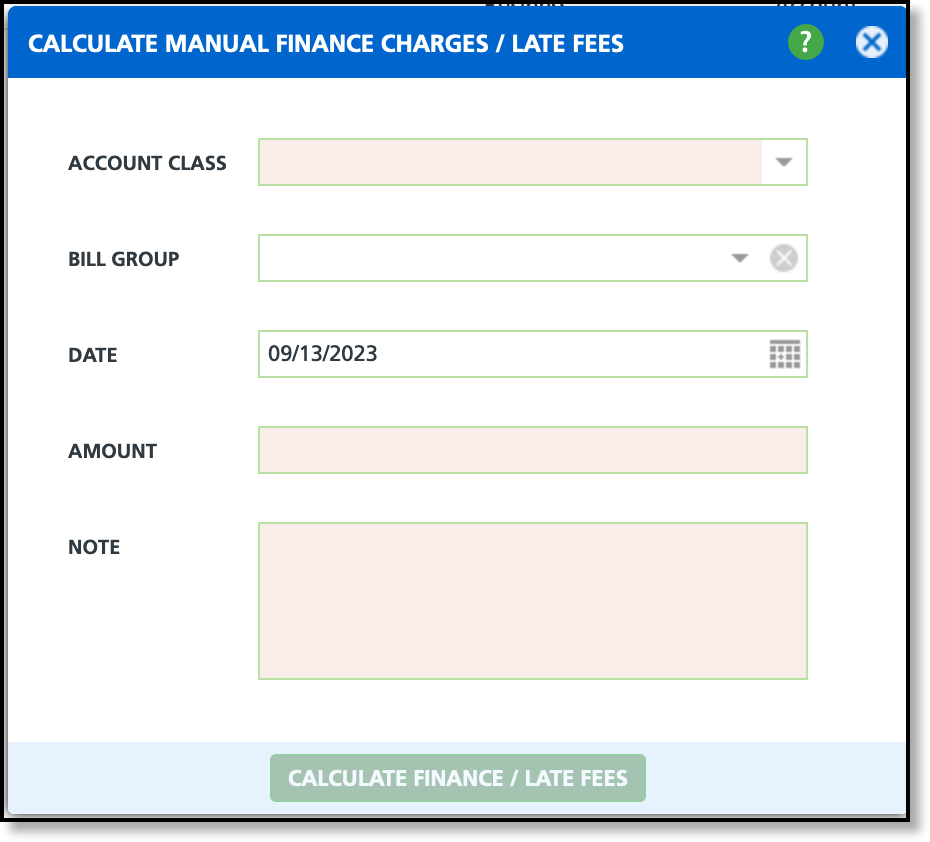

Pathway: Accounting > Calculate Manual Finance Charges and Late Fees

- Open Calculate Manual Finance Charges / Late Fees in the Accounting Module

- Select the Account Class the manual finance charge/late fee applies to.

- Select the Bill Group to identify the specific accounts the finance charge or late fee applies to.

- NOTE: This is important to select as not all accounts in the account class follow the same billing cycle.

- Enter a Date the finance charge code was assessed.

- Enter the Amount of the finance charge.

- Add a Note that will be included on the invoice with the Finance Charge/Late Fee.

- Follow your billing procedure and the manual finance charge/ late fee will be added to the invoices of past due accounts.

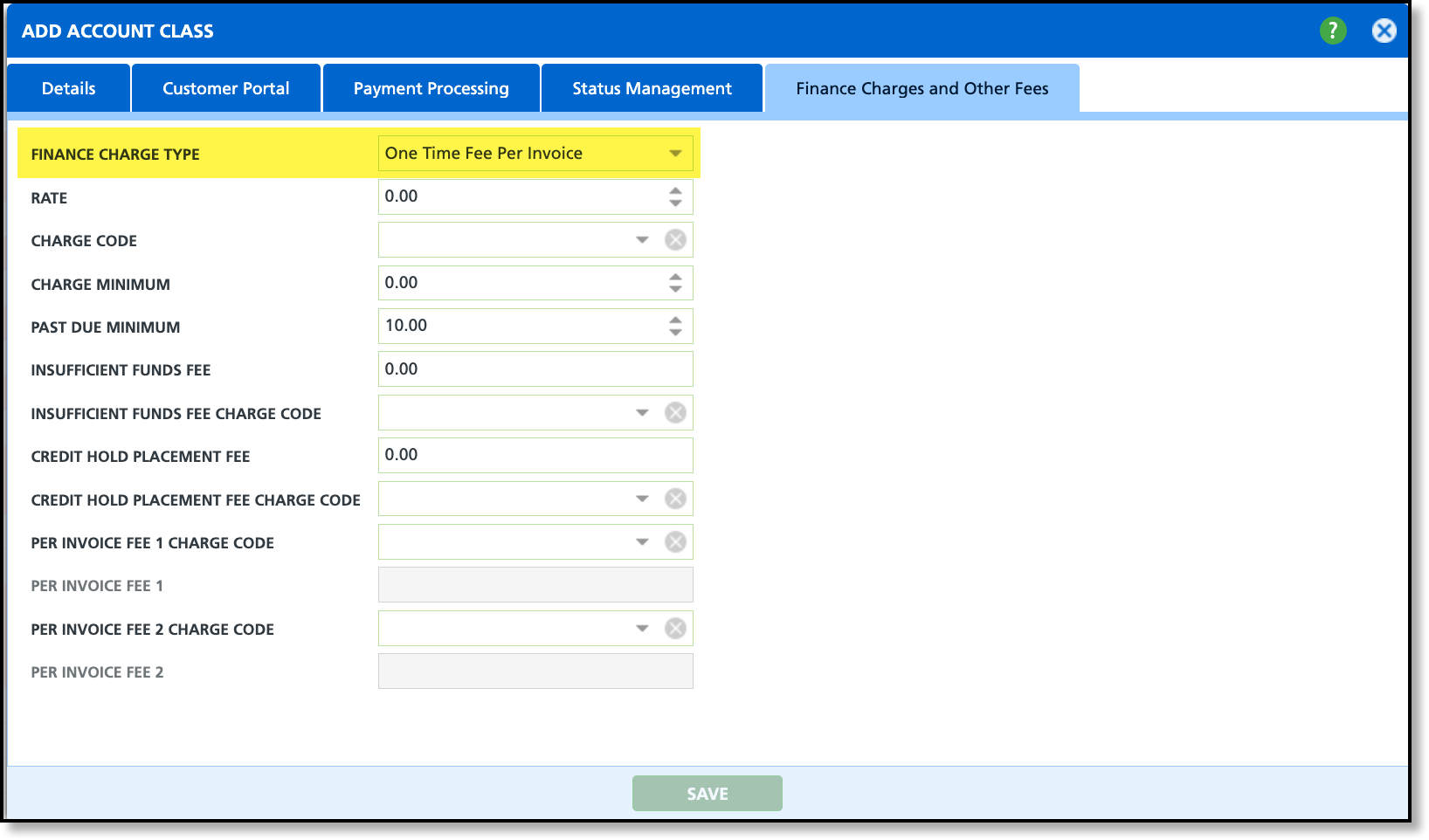

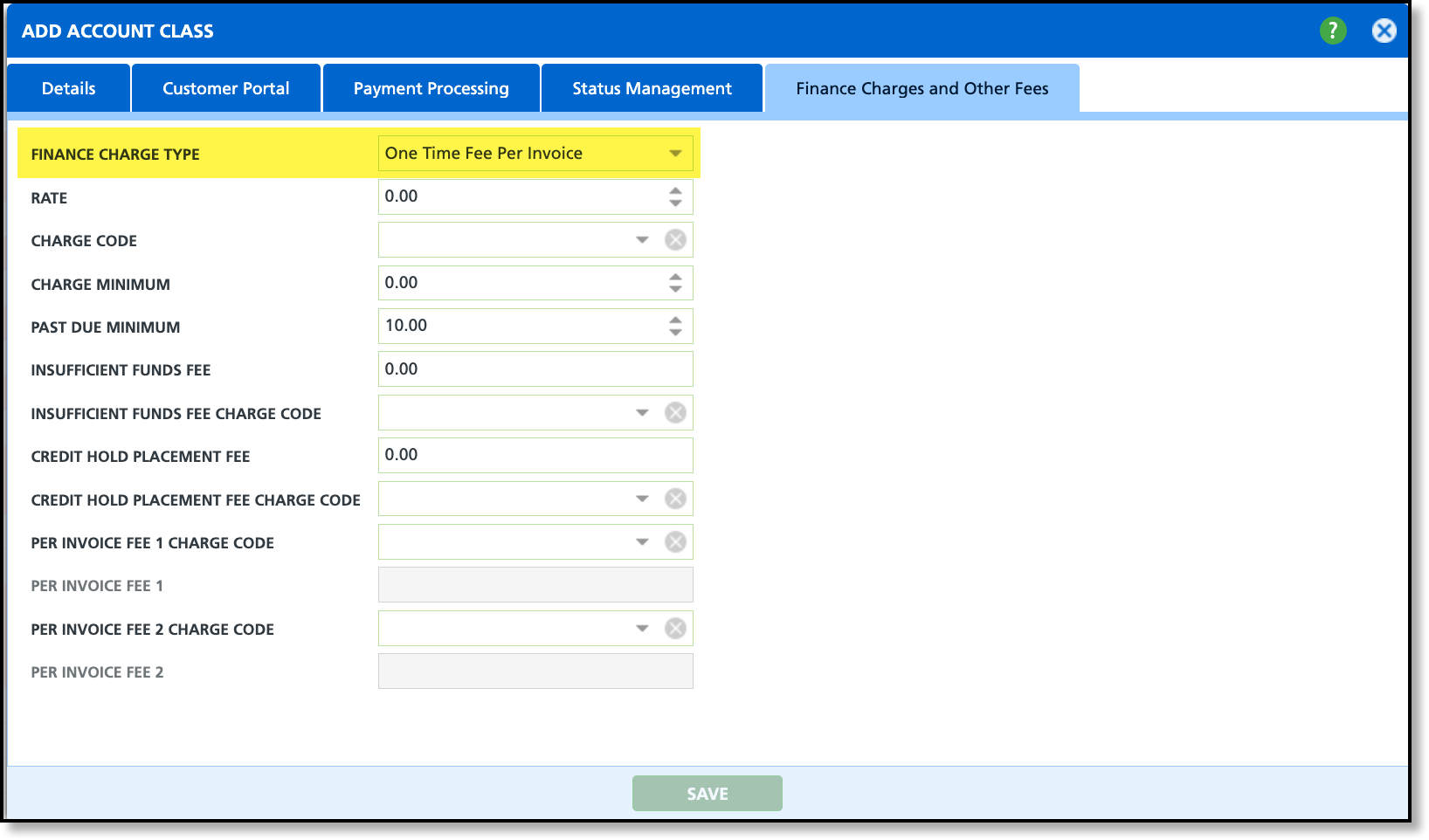

One Time Fee Per Invoice

With this option, a finance charge will be applied one time per invoice and is only calculated for scheduled batches.

- Select "One Time Fee Per Invoice" from the Finance Charge Type.

- Enter the Rate that will be applied on the invoice if a late fee applies. The rate for this finance charge type is a flat rate.

- Select the Charge Code billing should use when applying late fees to invoices.

- Enter the Charge Minimum; this is the minimum dollar amount an account must be charged. If the Rate is less than the charge minimum, the charge minimum is applied.

- Enter a Past Due Minimum; this is the minimum amount an account must be past due by in order for a finance charge or late fee to apply.