Surcharge Setup

Last Modified on 01/05/2026 6:52 am PST

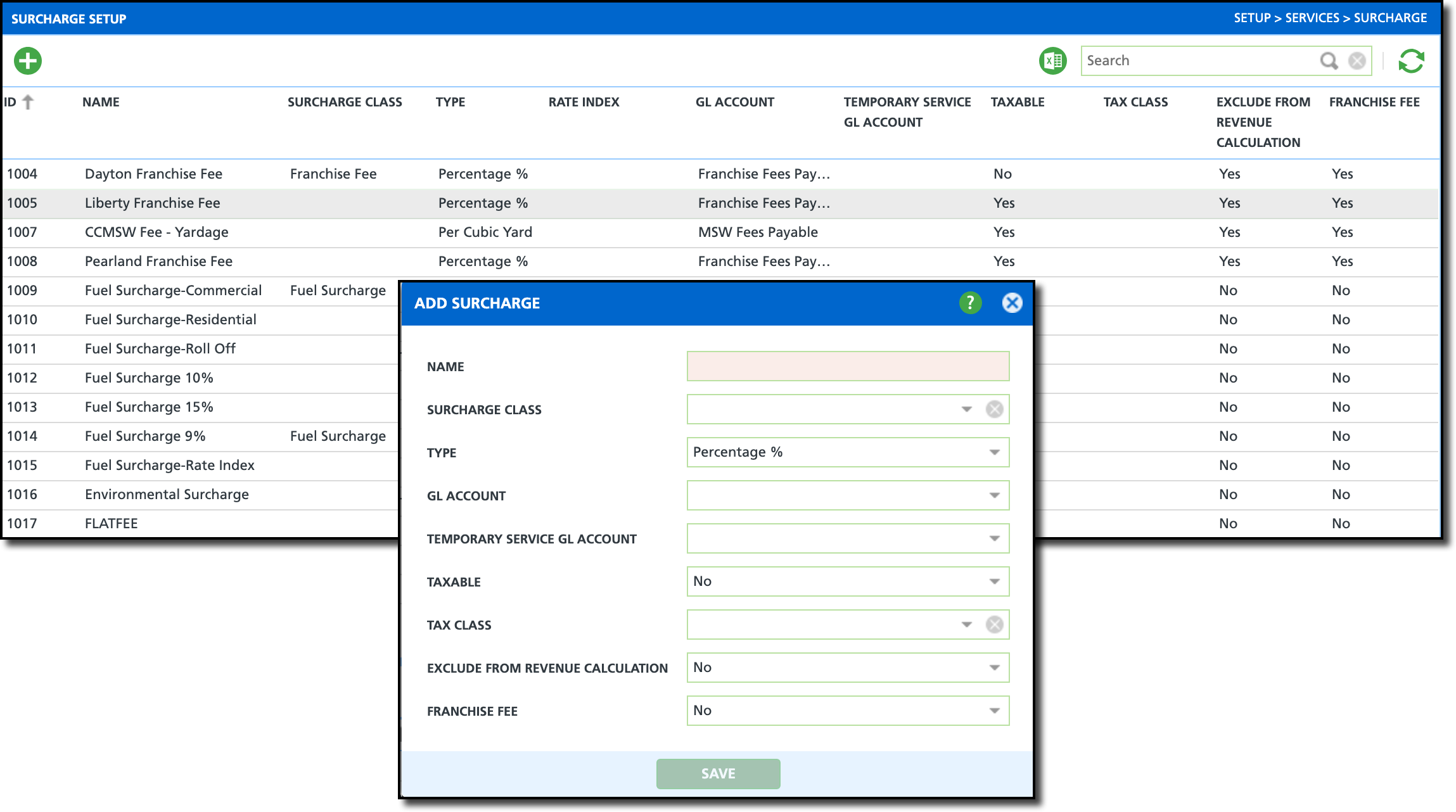

Pathway: Setup > Services > Surcharge

This article explains how to set up surcharges that can later be added to a surcharge group for application to a site's billing settings. Surcharges are additional fees applied to services and are included in a site’s billing setup through a surcharge group, which is a collection of surcharges applied to an account. After setup here is complete, review the Surcharge Group documentation to apply surcharges to sites through a surcharge group.

Permission Requirements

The following permissions are required to add surcharges:

Permission ID | Permission Name |

118

| Setup \ Services |

Field Descriptions

Fields | Descriptions |

Name

| The name of the surcharge.

|

Surcharge Class | Groups the surcharge into a class. When a surcharge is applied to a service, the assigned class will be displayed with it in a separate column/field. |

Type

| Select a Type to determine how the surcharge is calculated, such as a percentage of the charge or a flat fee applied during billing. |

Rate Index | This field will only appear if a Rate Index option is selected in the Type field. Rate index pricing must be established for this to apply. Refer to the Fuel Rate Index Surcharge article as an example. |

GL Account

| Displays a drop down list of GL accounts. If applicable, select the GL account that applies to the surcharge. More information about GL accounts can be reviewed here: GL Account Setup and Overview. |

Temporary Service GL Account | If revenue from temporary services is tracked at the surcharge level, select the corresponding GL account it should be tracked under. |

Taxable

| Indicates if the surcharge is taxable. - 'No' - surcharge is not taxable.

- 'Yes' - surcharge amount is included in tax calculations during billing.

- 'Tax Class' - taxed through the Tax Class identified in the Tax Class field.

|

Tax Class

| Required field if 'Tax Class' is selected from the Taxable field.

|

Exclude From Revenue Calculation

| Indicates if the Surcharge should be excluded from company's revenue calculations.

|

Franchise Fee

| Indicates if the Surcharge is a Franchise Fee.

|

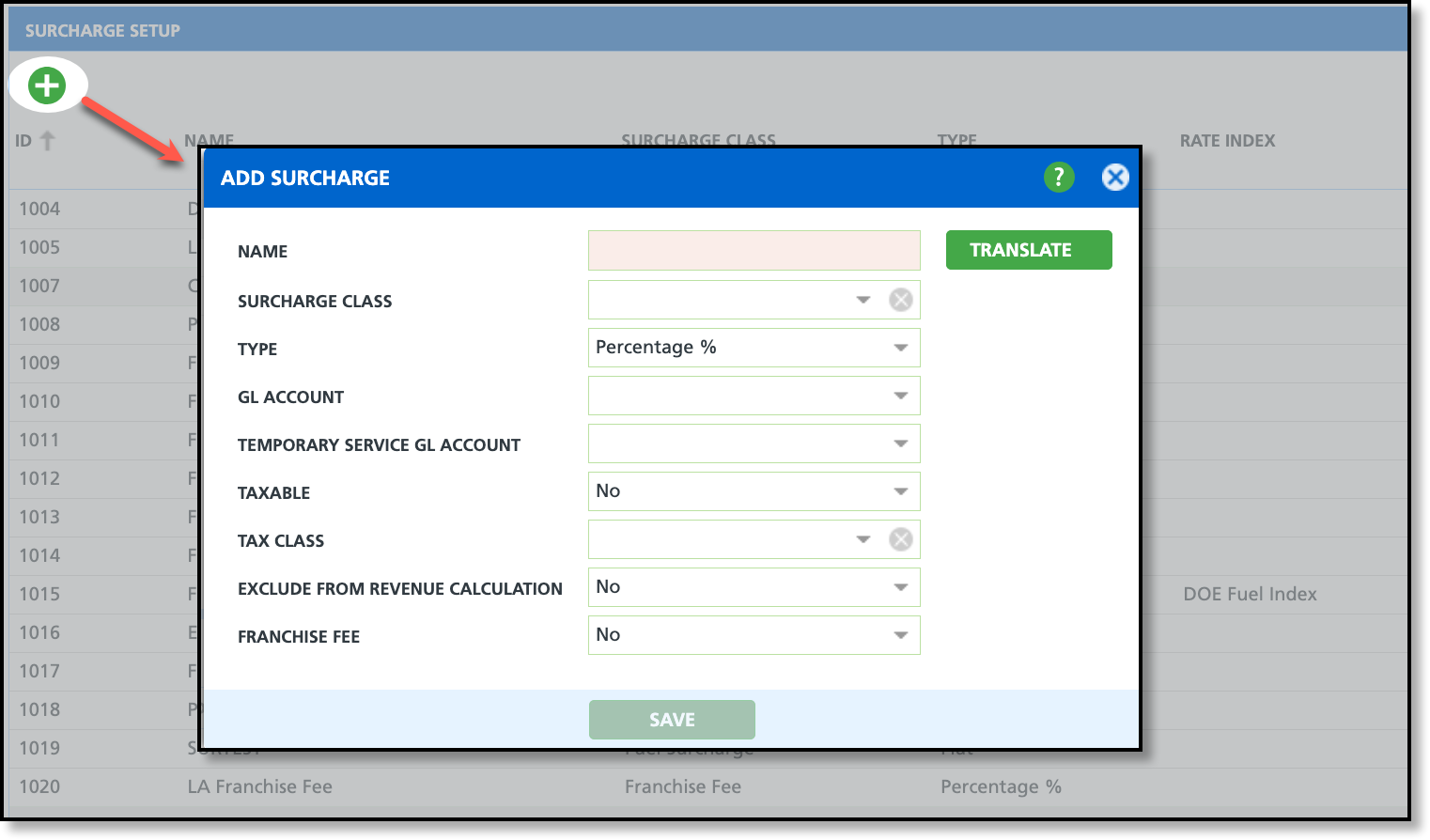

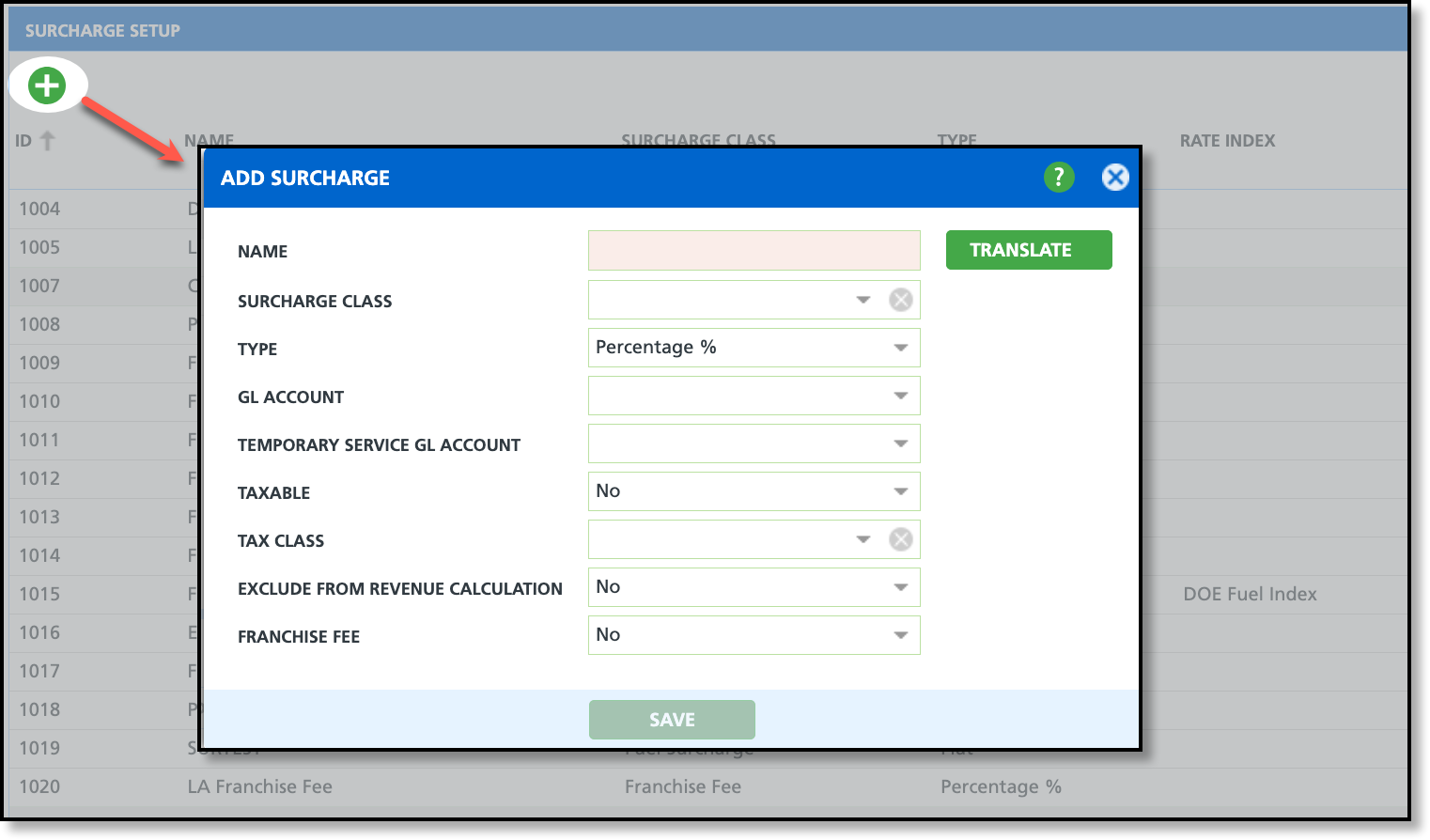

Add a Surcharge

Adding a new surcharge defines the surcharge and its core settings, including how the surcharge rate is calculated, GL tracking and taxability. Rates are configured separately, allowing the same surcharge to be used across multiple divisions and service regions where rates may differ.

- Click the Add icon from the Surcharge Setup screen. This will display the Add Surcharge popup editor.

- Enter a Name for the new surcharge.

- Select a Surcharge Class if one applies.

- Select a Type to determine how the surcharge fee is calculated.

- Select the GL Account the surcharge will be tracked under.

- Select if the surcharge is taxable and the Tax Class if one applies.

- If the surcharge should be excluded from revenue calculations, select No here.

- If a the surcharge is not part of a franchise fee, select No here.

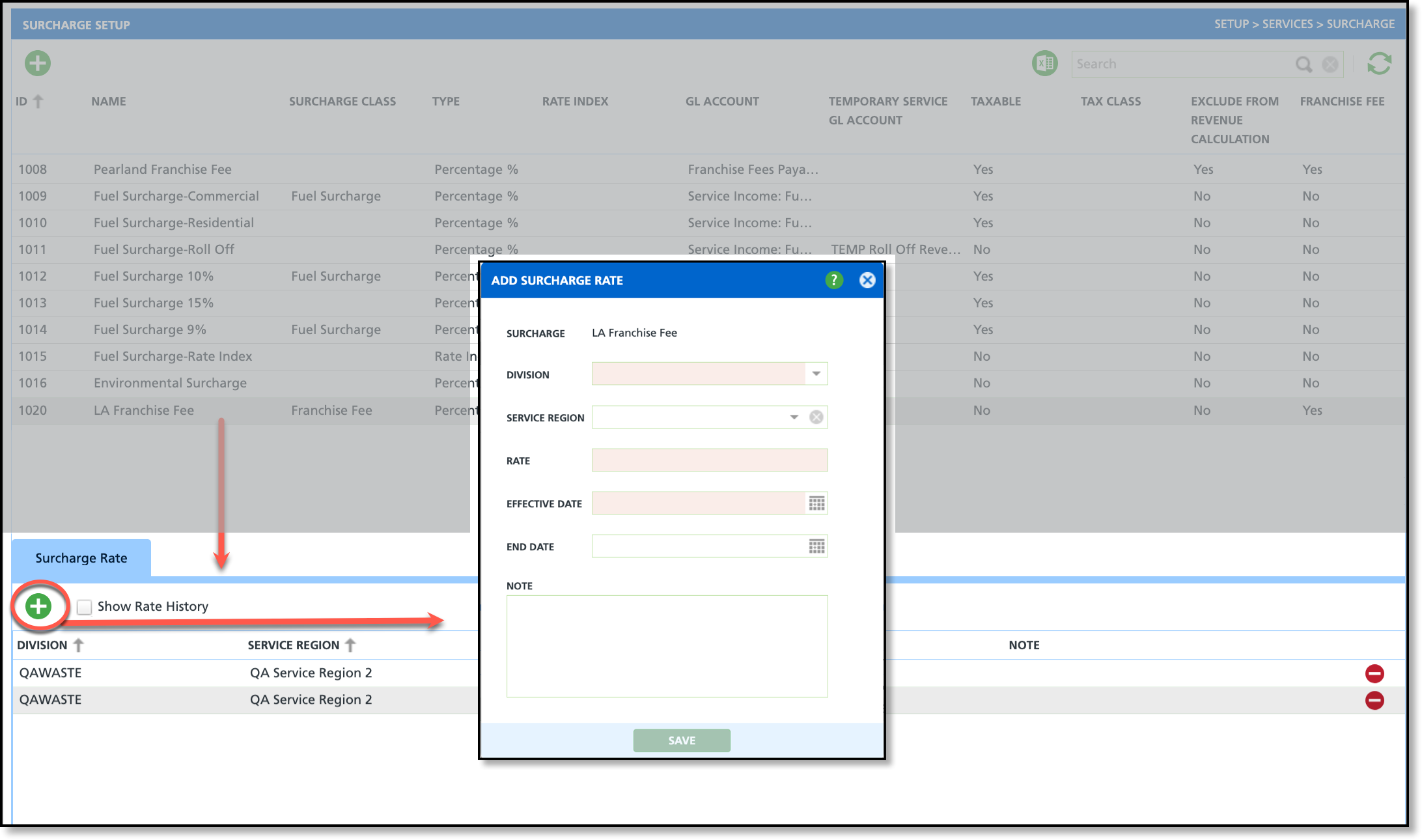

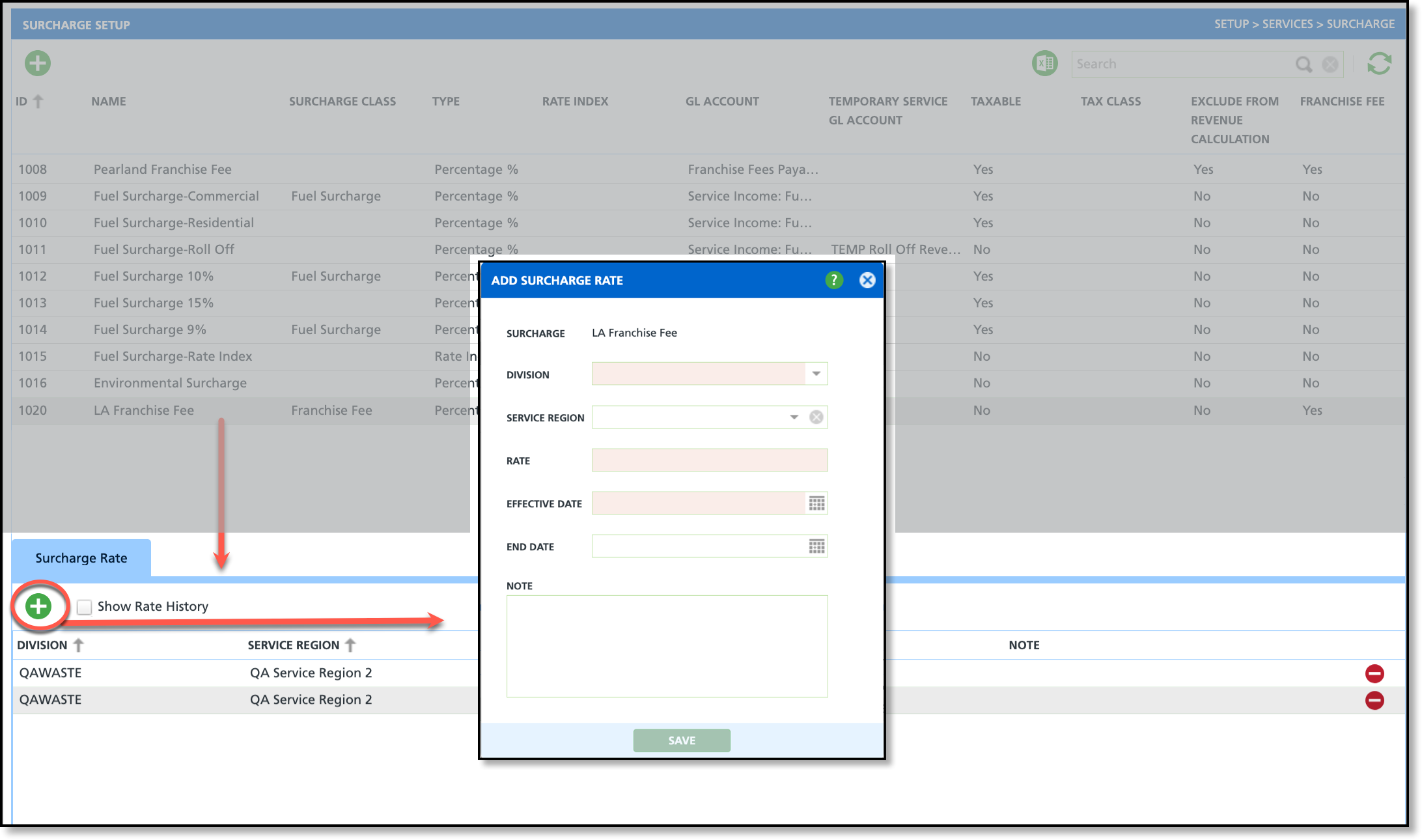

Add a Surcharge Rate

Once a surcharge is created, its rates can be applied based on division, service region, and effective dates.

- Click on a surcharge from the upper grid to display the Surcharge Rate tab in the lower grid.

- Select the Add icon to open the Add Surcharge Rate popup editor. Confirm the surcharge displayed is the correct before proceeding.

- Select a Division from the drop down list.

- If the rate applies to a specific service region, select the Service Region. Otherwise, leave blank and the rate will apply to all service regions within the division.

- Enter the Rate.

- Enter the Effective Date for the rate. If the rate is temporary and an end date is known, enter an End Date; otherwise, leave the End Date field blank and the rate will remain active.

- Add a Note if one applies and click Save when finished.

Next Steps

Once surcharges and their rates are created, add them to a Surcharge Group so they can be assigned to a site and included in billing.

Related Articles

Surcharge Group